When it comes to the accounting aspects of the manufacturing industry, there are certain financial common denominators. However, that's where the similarities end. Is your CPA firm treating you like every other manufacturer? If your accountant isn't offering the experience and flexibility to understand your specific goals, it is time to find one that does.

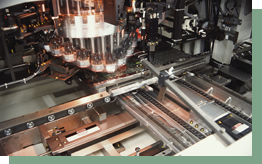

From businesses that create metal stampings to educational video producers and everything in between, we take a unique advisory role. Working as your confidant and a member of your executive team, we keep a watchful eye on profitability and success: short term and long term.

We can help you with issues that may significantly deter you from realizing your goals which include the following:

- Improper Compliance Filings- From multistate tax filings to annual 401(k) audits, we keep you current with all compliance requirements.

- Corporate & Personal Tax Filings - Vigilant in the tax preparation and filing of your returns, we're usually able to help you realize significant tax savings.

- Inadequate Succession & Exit Planning - Neglecting proper succession planning is one of the most costly mistakes manufacturing firms make. Don't leave the future of your enterprise to chance.

- Profit Enhancement - We can quickly analyze your current profitability by reviewing costing and pricing issues to then offer a precise course of action to enhance profitability and ROI in the future.

- Lack of Advisory Services - A host of business advisory services provide numerous ways to improve cash flow and increase income growth.

William Greene & Company services many domestic manufacturing companies and subsidiaries of foreign entities that have production facilities in the United States.

Contact us today for additional information on how we can help ensure the current success and future prosperity of your manufacturing company.